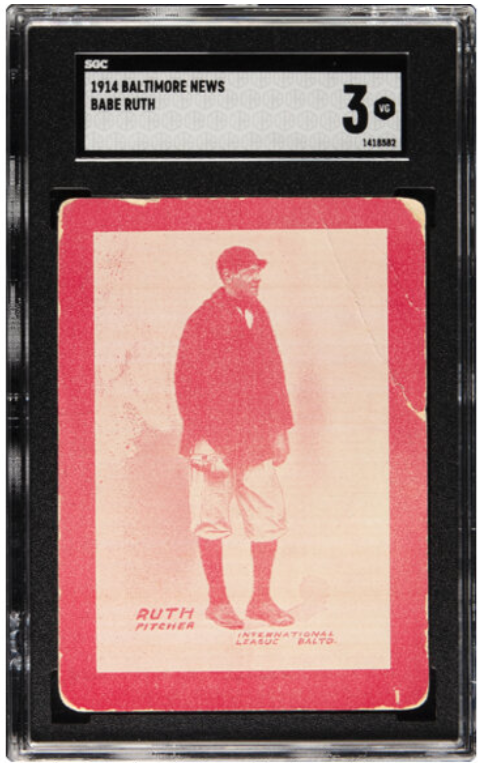

A 1914 Babe Ruth rookie baseball card sold a few weeks ago for an astronomical price of $4,026,000. You might think the seller was very happy with that, but probably not. That price represented a $3 million loss from what it was purchased for just two years ago. The price from December 2023 was $7.2 million. It was the third highest price ever paid for a baseball card, trailing only a Mickey Mantle rookie card that sold for an even more astonishing price of $12.6 million in 2022 and $7.25 million paid for a Honus Wagner card. The Mantle card makes the $7.2 million spent for the Ruth card almost seem like a bargain. If I owned the Mantle card I would not try to sell it now.

This is almost certainly the largest ever loss on a baseball card, probably any trading card, ever. The natural question is, “what happened?” This one isn't so easy to answer.

The problem isn't the card itself. It is of major importance, at least in terms of baseball card collecting. There is no more iconic figure in the history of baseball than the “Sultan of Swat,” Babe Ruth. He was not only arguably the greatest player but also likely its greatest personality. He was no teetotaling, clean-cut, milquetoast personalty and the fans (at least most of them) loved him for it. However, when this card was printed in 1914, Ruth was but an unknown minor league pitcher, pitching for the Baltimore Orioles, not the current major league team but the International League Baltimore Orioles of long ago. This Baltimore News card is the first Babe Ruth baseball card ever published.

Why then did it lose $3 million in value in the last two years? Discussions on sports card collector sites have speculated about various possibilities, such as card condition, but the most cogent explanation is that it was never worth $7.25 million in the first place. Collectibles of all sorts have experienced great price inflation in recent years. In 2023, after emerging from the period of Covid isolation, money often flowed too freely. Even the stock market has seen prices inflate to extreme levels, with its sustainability in question. The issue may be that it was swept up on a tide of optimism and giddiness that couldn't last. It reminds us of the Jerome Kern rare book sale in 1929, just before the stock market crash. Kern sold his books for the peak “Roaring Twenties” prices, with the buyers left with books that took 20 years to recover their 1929 prices.

Is there a lesson in this? Of course there is. Will we learn it? No. We never do. Maybe for a little while we do, but when the next “bubble” comes along, we will jump in. It's human nature. It's why the government can sell billion dollar lottery tickets that everyone buys and no one wins. We dream big. Paying $7 million, or even $4 million for a 2 5/8” x 3 5/8” piece of cardboard with a picture on it is ridiculous. This operates much like a Ponzi scheme. It works so long as someone else will pay even more for what you purchased. When you're the one who holds the merchandise when no one is willing to pay more, you are the inevitable loser. Many people made some serious money on the way up, while one person took a beating in the end. Tread carefully. Never, never, never pay more for a baseball card, a book, or anything else than you can afford to lose. S*** happens. Be prepared.

![Il Ponte, Feb. 25-26:

HAMILTON, Sir William (1730-1803) - Campi Phlegraei. Napoli: [Pietro Fabris], 1776, 1779. € 30.000 - 50.000 Il Ponte, Feb. 25-26:

HAMILTON, Sir William (1730-1803) - Campi Phlegraei. Napoli: [Pietro Fabris], 1776, 1779. € 30.000 - 50.000](https://ae-files.s3.amazonaws.com/AdvertisementPhotos/0372eeb9-97e1-47b2-baca-b3287d4704ee.jpg)

![<b>Il Ponte, Feb. 25-26:</b> [MORTIER] - BLAEU, Joannes (1596-1673) - Het Nieuw Stede Boek van Italie. Amsterdam: Pieter Mortier, 1704-1705. € 15.000 - 25.000 <b>Il Ponte, Feb. 25-26:</b> [MORTIER] - BLAEU, Joannes (1596-1673) - Het Nieuw Stede Boek van Italie. Amsterdam: Pieter Mortier, 1704-1705. € 15.000 - 25.000](https://ae-files.s3.amazonaws.com/AdvertisementPhotos/8f9ce440-b420-4407-8293-eb8e1b38ca19.jpg)

![<b>Il Ponte, Feb. 25-26:</b> TULLIO D'ALBISOLA (1899-1971) - Bruno MUNARI (1907-1998) - L'Anguria lirica (lungo poema passionale). Roma e Savona: Edizioni Futuriste di Poesia, senza data [ma 1933?]. € 20.000 - 30.000 <b>Il Ponte, Feb. 25-26:</b> TULLIO D'ALBISOLA (1899-1971) - Bruno MUNARI (1907-1998) - L'Anguria lirica (lungo poema passionale). Roma e Savona: Edizioni Futuriste di Poesia, senza data [ma 1933?]. € 20.000 - 30.000](https://ae-files.s3.amazonaws.com/AdvertisementPhotos/71bb9667-5d66-4aa8-96a2-9880c74a7a26.jpg)