In my February 2022 article for RBH, we parsed out the numbers from last year to understand if and how change is occurring within the auction markets for rare books, prints and ephemera. From analyzing the charts (www.rarebookhub.com/articles/3135) we were able to determine a concentration of auction houses hosting the bulk of auction events, resulting in an increase of supply through the market.

More lots are out there than ever before, however competition is tight and the profitability of each auction event has never been more crucial for auction houses caught in the middle range of the market.

This article will look at the micro-level of the auction event itself to provide an analysis of the economics of the auction event in order to understand emerging trends and tendency within the market. If you are going to work with auction houses, best know how they make money.

(www.rarebookhub.com/articles/3044)

The graph provided imagines the revenue and cost curves of two distinct auction events, the Value Model (#1) and the Volume Model (#2).

Revenue curves

The revenue curves are generated by multiplying the Gross Auction Value by the seller’s commission and the buyer’s premium and adding any service revenues that might occur. Gross Transaction Value (GTV) represents total proceeds from all items sold at the auction houses’ in person auctions, and online marketplaces. Auction Revenue is generally 15-30% of the Gross Auction Value.

The angle of each revenue curve provides insights into the average value of each lot offered in the auction, with the steeper curve of the Value Model being indicative of an auction event with higher value items and the shallower curve of the Volume Model being an auction event containing lower value items. The Value Model, because there is a higher contribution to profit per lot, has a lower breakeven point (the point in an auction event where all fixed costs are covered by revenues) than that of the Volume Model. As shown in the graphic, the Value Model is profitable (the point at which the revenue line exceeds the Total Cost curve) with the sale of many fewer lots (150-175 lots) than the Volume Model (300-325 lots). In reality, the Revenue Curves are indicative of two different auction event business models.

Cost curves

Some of the costs for an auction event are fixed and some costs are variable. The fixed costs of an auction event, usually allocated from a pool of fixed costs from the auction houses, do not vary as a function of the number of lots presented or lots sold. Big drivers of fixed cost in any auction business are facilities costs and the salaries of staff. As you can see from the graphic, the Fixed Cost curve is flat, and does not vary across all numbers of lots; both Value and Volume Models face the same fixed cost of the event.

Variable Costs relate to a specific auction and can include unique auction event marketing, product acquisition costs and specific staffing requirements driven by the auction event. As you can see from the graphic, the variable costs layer on top of the fixed cost to provide a Total Cost line.

As previously noted, Profit (Total Revenue greater than Total Cost) for the Value Model occurs at 150-175 lots, while the Volume Model require the sale of 300-325 lots to be profitable. These are two different auctions likely held by two auction houses with differing business models and strategies.

Event Profitability

Each auction event has a profit dynamic. In order to increase revenue an auction house needs to increase Gross Transaction Value (GTV). This can be achieved by either increasing the number of units offered or increasing the unit value of items offered. The Volume Model’s draw being a confluence of many, lower prices lots resulting in an increased sell thru rate (STR), the Value Model’s draw being the showcasing of a few, rare items to achieve the same GTV objective.

Another way to increase profitability of an auction event is through increasing revenue per unit by increasing either the seller’s commission or buyer’s commission (or both). This can be justified if evidence of high STRs can be demonstrated, supported by an infrastructure of client management programs and multi-prong marketing campaigns.

At the same time, decreasing costs by reducing variable costs per unit and/or reducing fixed costs need to be continually reassessed by the auction house. For example, a major method by which to reduce auction event cost levels is by transitioning auction events from in-person to online formats. We saw this prior to the Pandemic by a few auction houses, then almost ubiquitously during. This digital transformation of the auction industry is likely structural meaning that we will not likely completely return to the “old way” of heavy reliance on in-person auction events. As a result, many auction event costs will be permanently driven downwards.

Auction business profitability moving forward

An auction business is a portfolio of individual auction events. Not all auction events need to be profitable, but the portfolio of auction events when consolidated over the year needs to be or the auction house will not survive. As was observed in the previous article, there are many more in the ecosystem, mostly in the low/mid-price range.

At present, within each auction event and after, auction houses running a legitimate growth strategy are seeking to increase the revenue per event, decrease the variable costs per event and decrease the fixed costs per event.

Moving forward, the following responses are indicative of auction organizing adapting to the structural changes underway:

Commission percentages paid by both Buyers and Sellers will likely continue to rise with more services invented and delivered to augment auction revenues.

On-line auction events will become the rule rather than the exception as all auction houses seek to drop the level of fixed and variable costs in their operations. Sizes of auction events (number of lots offered) will continue to increase until an “optimum event size” is discovered that maximizes profit per event.

The number of auction events per auction house will continue to increase in order to spread fixed costs over more auction events. This will continue subject to the constraints of consignment availability and the willingness of auction houses to invest in new, expanded infrastructure (i.e. online platforms and further intelligence toward targeted marketing of yet unidentified collector clients).

Investors will likely get an opportunity to invest in the publicly listed shares of auction houses as established firms such as Sotheby’s (again) go public (https://news.artnet.com/market/sothebys-takes-another-step-ipo-2060295) or K Auctions in South Korea (http://www.koreaherald.com/view.php?ud=20220113000959&np=1&mp=1) to raise money to grow and expand infrastructure and venture backed auction houses, such as Catawiki, go public to create liquidity for the original investors.

The forces impacting the rare book auction market are bigger than books. The economic drivers as outline above seem unfamiliar because they are originating from areas of the economy (Capital Markets, Digital technology, Social Media marketing and Cloud-based auction platforms) that have not historically played a major role in rare book, manuscript, and ephemera ecosystems. However once introduced, these forces have permanent impacts on the bottom lines of auction houses and the services they provide Collectors and the Trade.

About Spencer W Stuart

Spencer W Stuart provides analytic services to collectors and dealers using auctions to build their collections and inventory. For Dealers, Spencer provides consulting services to develop hybrid or total transitions of book business to the use of auction mechanisms as a growth strategy.

In concert with his advising, Spencer is an active writer and lecturer on histories of the printed word for a variety of publications including The Book Collector and Amphora as well as with the Canadian Broadcasting Corporation.

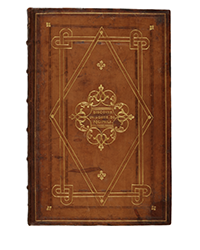

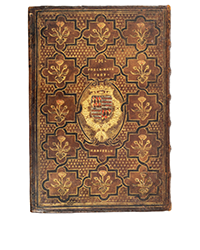

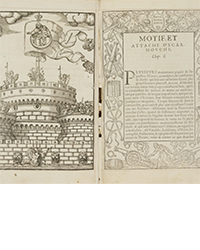

![<b>Heritage, Dec. 15:</b> John Donne. <i>Poems, By J. D. With Elegies on the Author's Death.</i> London: M[iles]. F[lesher]. for John Marriot, 1633. <b>Heritage, Dec. 15:</b> John Donne. <i>Poems, By J. D. With Elegies on the Author's Death.</i> London: M[iles]. F[lesher]. for John Marriot, 1633.](https://ae-files.s3.amazonaws.com/AdvertisementPhotos/8caddaea-4c1f-47a7-9455-62f53af36e3f.jpg)

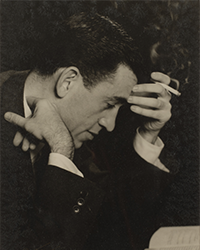

![<b>Sotheby’s, Dec. 16:</b> [Austen, Jane]. A handsome first edition of <i>Sense and Sensibility,</i> the author's first novel. $60,000 to $80,000. <b>Sotheby’s, Dec. 16:</b> [Austen, Jane]. A handsome first edition of <i>Sense and Sensibility,</i> the author's first novel. $60,000 to $80,000.](https://ae-files.s3.amazonaws.com/AdvertisementPhotos/9a74d9ff-42dd-46a1-8bb2-b636c4cec796.png)