The last year has been a whirlwind for the auction market. In the early months of the Pandemic, when the Trade and book fairs scrambled to work out online platforms and the possibilities of sourcing new material to offer collectors were closing, the book departments of auction houses had a head start, aided by their pre-existing infrastructure. At the same time, collectors, housebound with extra financial resources, grew more comfortable with online auction platforms. During this period, I observed some of my clients (normally hesitant in online auctions) growing more familiar with the process for sourcing material to shape their collections.

This migration of catalogue- and fair-centric collectors to online auction platforms is not an isolated occurrence. A wider survey of the numbers reflects this. Looking back a year, the ‘Average Median Auction Price’ is up $380 from roughly $2,670 in April 2020 to $3,050 in April 2021. During the same period the ‘Sell Through Rate’ increased from 79% to 83%. Does this indicate a seismic shift is taking place? It’s hard to say on a short timeline. Time will tell whether this was the by-product of the circumstances or a major structural change resulting in real growth in the auction market.

As alluded to, one of the major drivers of the observed growth was that the infrastructures developed by the auction houses allowed for a smooth transition (not to mention search engine optimization already in place to enhance visibility). The second driver was the opportunity to supply the demand which the Trade was unable to fill on account of its limited channels to market and, in some cases, the requirement of complete overhauls in their business strategy. Of course, this was not the case for all dealers. Indeed, some dealers reported better than average sales for the year. However, few revealed whether or not such figures were after expenses (which would have dipped considerably if one relied solely on fairs and catalogues). Another phenomenon mentioned by Dealers was the opportunity to go into their backlog of uncatalogued items. The result has been a palpable enthusiasm among the Trade and the production of truly individual catalogues.

From another angle, what might these figures tell us? Not simply that auction houses were satiating the demand not being fulfilled by the Trade, but that the quality (rarity and/or condition) of the material on offer was exceptional. Certainly, the many deaccessioning efforts during the Pandemic as well as the increase of dedicated Collector sales presented unique, once-in-a-lifetime opportunities. Combine this with the reallocation of book department expense accounts from travel to marketing and the buzz begins — as we’ve seen over the past few months.

Now, is this sustainable? As populations in North America and Europe continue getting vaccinated and health measures loosen, it will be important to watch both the ‘Average Median Auction Price’ and ‘Sell Through Rate’. Already the sell through rate from February 2021 to April is seeing a decrease of 0.7%, perhaps indicating that buyers are starting to source material elsewhere as dealers are more able to conduct house calls and in-person Fairs open up again.

But, during this period of social isolation, I have observed some interesting structural transformations. The aforementioned reticent collectors had the time to examine their collections more deeply, conduct independent research, examine comparables for material they were seeking, and, overall, become more self-reliant and open to the idea of diversifying the channels through which they source material.

The announcement made by Donald Heald in the June 2021 issue of Rare Book Hub Monthly that his firm will hold auctions, further reflects this shift as, “both buyers and sellers are increasingly expressing a preference for market-derived prices.” After almost a year, collectors have grown accustomed to the publicly available data provided through auction results. It is not surprising, therefore, that Dealers would want to stage auctions (if they can afford to do so) and align themselves with a more transparent process. The growth witnessed in the auction market over the past year might lessen, however its mechanisms will remain appealing to all involved (whether buyer or seller). What will be interesting to observe is how the transition of Dealers to adopt auction platforms will permanently change the structure of their businesses and how they conduct them.

Moving forward, for buyers In an environment of heightened activity, as a collector, it is important to separate the effects generated by the mechanisms of an ‘event’ from the means by which you are building your collection. In most cases, there will be other times at which an item can be acquired. Paying too much for an item has a corrosive effect on a collection as the reason for paying ‘that much’ is due to the perception that one has ‘sunk money’ into the collection. I have witnessed this phenomenon when analyzing the purchasing history of clients. Following a ‘bad’ purchase, enthusiasm and confidence in one’s collecting is called into question resulting in sporadic, less focused purchases or abandonment of the project altogether.

What is new in all of this? Events and environments that generate a sense of scarcity are integral to the momentum of the rare books and ephemera industry. Certainly, there are dealers who maintain close relations with collectors and have buyers in mind when sourcing material (ideally). However, there is now (more than ever) the chance of netting new collectors through online channels, offering fresh opportunities to those in the Trade.

Coming out of the COVID-19 pandemic, ‘time pressure’ tactics explicitly implemented by the auction mechanism have migrated over to the Trade which have often eschewed competitive bidding environments for one-on-one, trust-based relationships with collectors. Superficially, the constant presence of a countdown clock when browsing virtual fairs enforces a time pressure which is instrumental within auction environments to increased bidding.

Indeed, a hybridity is unfolding in the collecting markets of books, print material, and photography as auction houses seek new demographics of collectors to tap into and the Trade seek to source stock that has yet to be priced out. The auction houses want the cultural caché of the Dealers and, with it, net new marketing exposure that specialist, countercultural dealers possess; the Dealers are attracted to the sense of anticipation and urgency intrinsic to the auction event. This can, indeed, be a positive, symbiotic relationship. Swann’s recent ‘Salon Series’ roundtable with the recipients of the Honey & Wax prize entitled “Owning It: A Round table for Young Collectors” is an interesting collaboration. An attempt by Swann to facilitate a discussion around collecting in order to build trust and further legitimacy. Certainly, these distinctions of Trade and the Auction Market have been porous for some time as Houses often hire specialists from the Trade, not only for their expertise in cataloguing material but also to take advantage of their connections both to source property and attract bidders. Furthermore, the inclusion of less conventional material at auction (i.e. with evidence of performance at auction) seems to signal a further encroachment into the realm where the Trade solely operated.

It will be interesting to see how virtual elements are integrated into Book Fairs as they begin being held in person again, and whether or not it will augment (or distort) the overall experience. Speaking with clients who were new to the auction event, some admitted to an excitement in participating. This is certainly something that can be an advantage to sellers. There are forces at play when one makes use of time pressure and bidding that are fundamentally different to a transactional experience. Auction platforms hosted in the digital environment have the potential to open a Pandora’s box for collectors.

In conclusion, the developments in the auction market have important implications for both buyers and sellers. For buyers, auctions offer more information on prices, frequency of appearance, and condition of items than ever before. This should help buyers who have an acquisition strategy improve their buying. Additionally, items that have never before been available are showing up in dedicated collector auctions, as well as auctions supplemented by the deaccessioning activities of institutions. This presents opportunities to make big, strategic purchases for those with a plan. There is an elevated requirement for collectors to know their collections and have a collecting strategy before they venture out into the auction world.

For Sellers, strong auction price performance fueled by an influx of roughly a year of new data around client interaction (as well as the addition of net-new buyers with money to spend in the auction market) make it a good time to sell, creating liquidity for their collections. More participants on the buy side of the market, equipped with more information driving more confidence to purchase at auction is resulting in strong auction sell-through performance. An opportunity exists for collectors to fine-tune their collections by selling items that no longer fit their longer-term plan, generating capital to purchase items more closely aligned with their collecting strategy.

Spencer W Stuart will be delivering a talk for the Book Club of California expanding on these topics July 12th at 5pm [Pacific] to register: https://us02web.zoom.us/webinar/register/WN_Fp8WhqbyTgaVIuFvfHipxQ

About Spencer W. Stuart

Spencer W. Stuart provides advisory services to private collectors as well as institutions aiding in the design and execution of collection development, management and deaccession strategies.

In concert with his advising, Spencer is an active writer and lecturer on histories of the printed word for a variety of publications including The Book Collector and Amphora as well as with the Canadian Broadcasting Corporation.

He can be contacted directly through his site: http://spencerwstuart.ca/services/

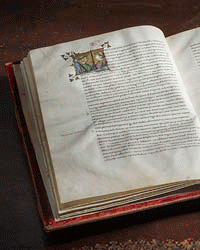

![Forum, Feb. 19: Lot 57[Album and Treatise on Hinduism], manuscript treatise on Hinduism in French, 31 watercolours of Hindu deities, Pondicherry, 1865. £3,000-4,000 Forum, Feb. 19: Lot 57[Album and Treatise on Hinduism], manuscript treatise on Hinduism in French, 31 watercolours of Hindu deities, Pondicherry, 1865. £3,000-4,000](https://ae-files.s3.amazonaws.com/AdvertisementPhotos/f70b3790-9b4a-4990-b402-f0322021c0de.jpg)

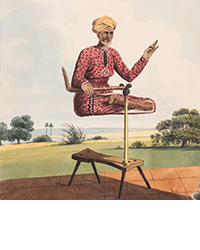

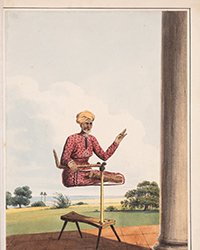

![Forum, Feb. 19: Lot 62 Allan (Capt. Alexander). Views in the Mysore Country,

[1794]. £2,000-3,000 Forum, Feb. 19: Lot 62 Allan (Capt. Alexander). Views in the Mysore Country,

[1794]. £2,000-3,000](https://ae-files.s3.amazonaws.com/AdvertisementPhotos/ad2cf7b4-4d93-4231-a956-b440583b39b3.jpg)

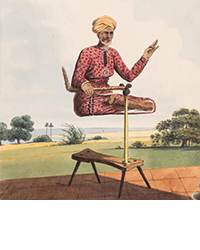

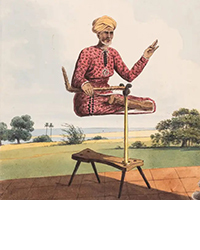

![Forum, Feb. 19: Lot 123D'Oyly (Charles). Behar Amateur Lithographic Scrap Book, lithographed throughout with title and 55 plates mounted on 43 paper leaves, [Patna], [1828]. £3,000-5,000 Forum, Feb. 19: Lot 123D'Oyly (Charles). Behar Amateur Lithographic Scrap Book, lithographed throughout with title and 55 plates mounted on 43 paper leaves, [Patna], [1828]. £3,000-5,000](https://ae-files.s3.amazonaws.com/AdvertisementPhotos/5651043b-3c0d-4e2c-931f-72133bda9b36.jpg)

![Forum, Feb. 19: Lot 205Marshall (Sir John) and Alfred Foucher. The Monuments of Sanchi, 3 vol., first edition, 141 plates, most photogravure, [Calcutta], [1940]. £3,000-4,000 Forum, Feb. 19: Lot 205Marshall (Sir John) and Alfred Foucher. The Monuments of Sanchi, 3 vol., first edition, 141 plates, most photogravure, [Calcutta], [1940]. £3,000-4,000](https://ae-files.s3.amazonaws.com/AdvertisementPhotos/8c8244b7-4573-44d3-9c70-e0d3a3ed3cc4.jpg)

![Il Ponte, Feb. 25-26: HAMILTON, Sir William (1730-1803) - Campi Phlegraei. Napoli: [Pietro Fabris], 1776, 1779. € 30.000 - 50.000 Il Ponte, Feb. 25-26: HAMILTON, Sir William (1730-1803) - Campi Phlegraei. Napoli: [Pietro Fabris], 1776, 1779. € 30.000 - 50.000](https://ae-files.s3.amazonaws.com/AdvertisementPhotos/0372eeb9-97e1-47b2-baca-b3287d4704ee.jpg)

![Il Ponte, Feb. 25-26: [MORTIER] - BLAEU, Joannes (1596-1673) - Het Nieuw Stede Boek van Italie. Amsterdam: Pieter Mortier, 1704-1705. € 15.000 - 25.000 Il Ponte, Feb. 25-26: [MORTIER] - BLAEU, Joannes (1596-1673) - Het Nieuw Stede Boek van Italie. Amsterdam: Pieter Mortier, 1704-1705. € 15.000 - 25.000](https://ae-files.s3.amazonaws.com/AdvertisementPhotos/8f9ce440-b420-4407-8293-eb8e1b38ca19.jpg)

![Il Ponte, Feb. 25-26: TULLIO D'ALBISOLA (1899-1971) - Bruno MUNARI (1907-1998) - L'Anguria lirica (lungo poema passionale). Roma e Savona: Edizioni Futuriste di Poesia, senza data [ma 1933?]. € 20.000 - 30.000 Il Ponte, Feb. 25-26: TULLIO D'ALBISOLA (1899-1971) - Bruno MUNARI (1907-1998) - L'Anguria lirica (lungo poema passionale). Roma e Savona: Edizioni Futuriste di Poesia, senza data [ma 1933?]. € 20.000 - 30.000](https://ae-files.s3.amazonaws.com/AdvertisementPhotos/71bb9667-5d66-4aa8-96a2-9880c74a7a26.jpg)