Book Prices Soared 15% at Auction in 2007

- by Michael Stillman

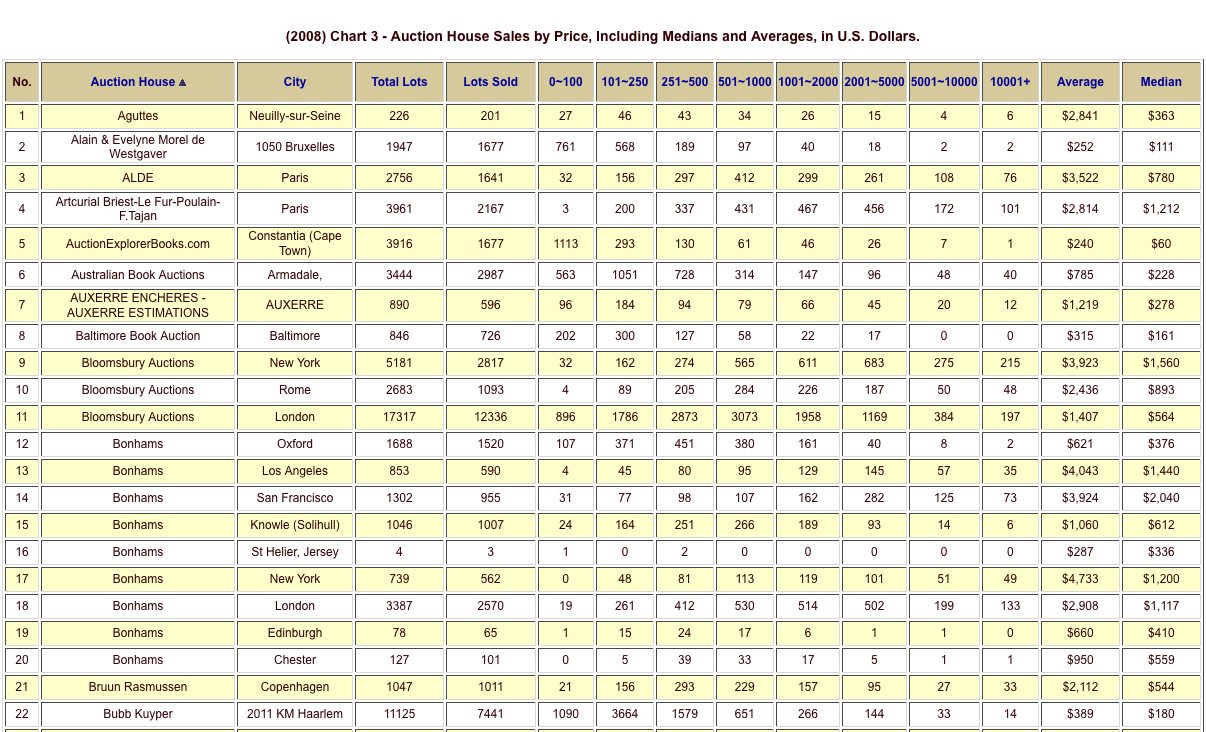

One of the auction charts available from AE.

By Michael Stillman

Book prices at auction rose sharply in 2007 following a couple years of very slow growth. The median price rose almost 15% last year, from $423 to $486. This follows a rise of less than 1% the year before. Volatility in exchange rates, as well a rebound in European markets that had been soft the prior two years, played a major role in the sharp increase. The average increase of 6% per year over the past three years may give a better picture of trends in the book market than does one sharply higher year following two flat ones.

These prices are based on U.S. currency, but the collapsing dollar wreaked havoc on an orderly marketplace. While prices rose 15% in terms of dollars, they rose 13% in British pounds and only 3% in Euros. Such was the collapse of the American dollar.

Book prices at auctions held in America for American buyers (using U.S. dollars) rose by a more modest 9%. However, for European buyers computing their purchases in Euros, prices in America actually declined by 3%. In European auctions, prices for Europeans rebounded sharply, increasing 16% after several soft years. However, for American buyers using declining dollars, prices in Europe shot up by almost 30%, making that marketplace prohibitive for Americans. The phenomenon in books was similar to that for Americans purchasing fuel for their cars and homes – a substantial increase in underlying prices coupled with a collapsing dollar resulted in huge increases in costs.

Prices in the British market were the least volatile. The increase was a modest 1% for those buying in the local currency, while the British pound had only a relatively modest gain versus the U.S. dollar in 2007 after experiencing a sharp gain the year before.

The average price at auction took an even steeper incline than the median, rising 36% from $2,557 to $3,476 in 2007. However, average prices are easily skewed by a few very large sales and therefore are not as indicative of market conditions. Last year's $21 million sale of a copy of the Magna Carta was sufficient by itself to add $140 to the average sale price of all items.

While prices shot up, other sales numbers remained largely unchanged. In 2007, 75% of the lots offered were sold, 25% unsold, unchanged from 2006. Once again, 49% of items sold went for more than the high estimate, while 27% went for less than the low estimate, one percent less than last year. However, when unsold items are factored in, it shows that 45% of the items offered either sold for less than the low estimate or not at all, versus 37% of all items offered selling over the maximum. These figures too were unchanged from 2006.