Trends in Book Auction Prices Updated

- by Bruce E. McKinney

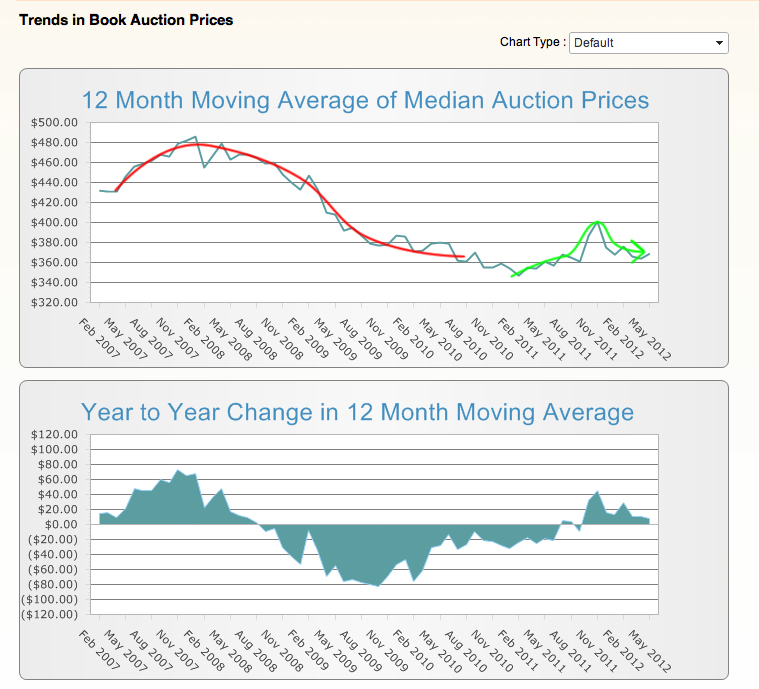

Mild recovery now a year old

AE has updated its “Trends in Book Auction Prices” providing evidence the muted recovery, as measured by median lot realizations, that took hold in March 2009 continues to find traction today. The median lot value in April was $369, up from the low of $350 made in April 2010 but far below the high of $482 achieved in March 2008. These results suggest the market will continue to recover at a modest rate for at least another year.

Some distortion in the numbers may be due to more material being diverted into the rooms. If a dealer’s sales are soft the ready option is always to send expendables into the rooms. Probably weighing down prices overall is the increasing volume of material on offer. This past April close to a hundred sales took place. Five years ago this was an unthinkable number.

At the same time the houses seem to be requiring lower reserves if not estimates. The business makes money north of 70% and the 12-Month Moving Average of Sell Through is now reflecting a 2% decline from the previous 70%. The rate of sale is probably the most crucial metric for a house in determining its strategy.

Within these statistics there is another story, the relationship between auction and dealer sales. We have no hard data on dealer sales but believe that auction hammer prices [to which auction commission must be added] are barely 50% of dealer retails before discounts.

Taken together, this is probably what the recovery in the rare book trade looks like in a world economy that takes its temperature every 24 hours and keeps asking “Am I okay?”

The answer is a qualified yes.